📉 August’s Reverse Mortgage Dip: Less Volume, Same Power Players 🏡💼

Hey fam—we’ve got some market tea to sip ☕️ and it’s served cold. The reverse mortgage sector just hit a bit of a turbulence patch. 🛑 In August, Home Equity Conversion Mortgage (HECM) endorsements clocked in at just 2,062—down 13% from July and the lowest we’ve seen since February. 😬

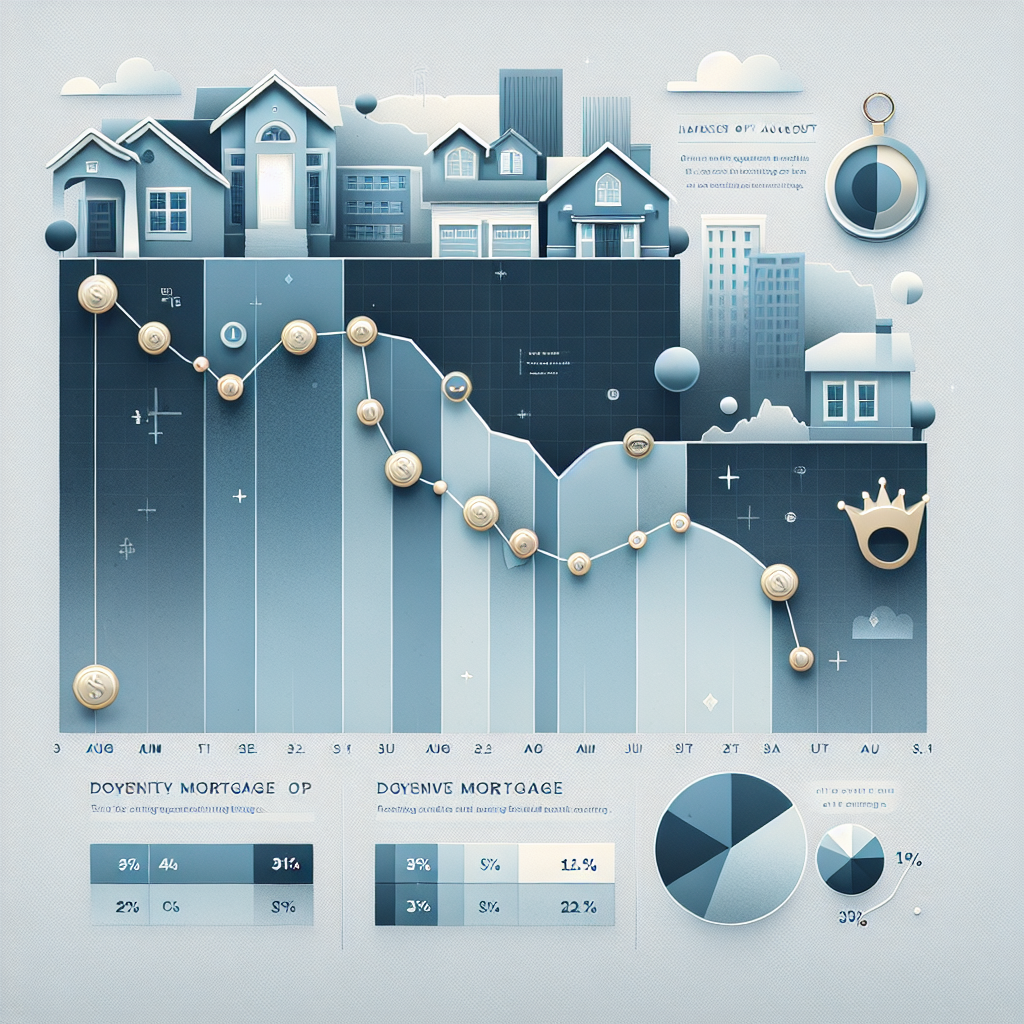

The data’s hot off the virtual presses from New View Advisors, and while volume dipped, the story’s really about market concentration. Only three players are holding almost two-thirds of the game. Yup, you read that right 📊:

🏆 Mutual of Omaha Mortgage led the charge with 460 loans in August, flexing with a commanding 23% market share over the past year.

🥈 Finance of America (FOA) trailed closely with 402 loans.

🥉 Longbridge Financial locked in 306 loans.

Together? These three titans owned 61% of all HECM endorsements from September 2024 to August 2025. Talk about centralized strength. 💪

🌎 Regionally, California’s Santa Ana Homeownership Center is still the MVP for volume, processing 699 endorsements in August. That’s down from its peaks, sure—but it’s still outpacing Atlanta (497) and Philly (427) like a boss.

💼 On the wholesale side, Longbridge Financial is running the show, sponsoring over 3,358 loans in the past year—yep, that’s wholesale sponsor dominance. FOA followed with 2,518. No updated wholesale data for August, but the June numbers already foreshadowed this trend with FOA leading (242 loans).

But wait—there’s more 🔍📉

August also saw a chill sweep across the HECM Mortgage-Backed Securities (HMBS) realm. Issuance fell to $502 million, a $39 million drop from July’s $541 million. Looks like pools got smaller and cooler:

🌀 FOA: $152M (-$3M from July)

🌀 Longbridge: $111M (-$3M)

🌀 Mutual of Omaha: $98M (-$7M)

🌀 PHH Mortgage: $87M—a steep $21M decline

And let’s pour one out for Ginnie Mae’s Reverse Mortgage Funding portfolio 🪦, which issued no HMBS pools. Again.

Digging deeper: First-participation HMBS production—which sounds like a niche EDM genre but is very much not—totaled $322 million in August (down from $343M in July 🙃).

And wagons, circle up: tail issuance (that’s when later portions of a reverse mortgage get chopped up to back new securities) slowed to $179 million from July’s $197 million. Still action, but the vibe is definitely “cooling off.”

A very modern touch? 19 minipools with less than $1 million each became a thing in August thanks to Ginnie Mae’s progressive rule change allowing pools as small as $250,000. Tiny but mighty. 💸✨

ICYMI, Ginnie’s 2023 APM 23-11 also made it easier to squeeze more juice out of every loan, allowing participations to be pooled more than once per month. In August, that translated to $58.1 million, including $2.6M in fresh first participations.

🧠 So… why does this matter?

In a sector so dependent on regulatory tweaks, secondary securitization, and economic turns, these numbers tell a nuanced story: the market is quieter, yes, but not shrinking. It’s reconsolidating. Smaller pools, leaner issuance, concentrated lenders. Think “bear mode” but with claws still out. 🧸💅

And who thrives during downturns? Strategic players. FOA, Mutual of Omaha, and Longbridge aren’t just coasting—they’re calibrating.

👀 Keep watch, reverse mortgage fam. When volume drops but dominance consolidates, innovation often steps in next. And that’s where your girl Anita’s got eyes on the prize: real-world asset tokenization, AI-powered mortgage advisory tools, and smart contracts that could make reverse lending smoother, faster, and dare I say… sexy?

Because remember: markets may stall, but innovation never sleeps. 💻⚡️

Stay sharp, digital dreamers. 🚀

– Anita