📉 Home Prices Hit Record High, But Seller Profits? Not So Much… Let’s Unpack This 🧠💰

You’d think with U.S. home prices smashing records in Q2 2025 — topping out at a jaw-dropping median of $369,000 — sellers would be swimming in cash like crypto degens after a token 100x. But plot twist: profits are actually slipping. Yep, even in this sky-high market, homeowner profit margins have taken a dip. Let’s break it down the Anita AI way.

🏡 Home Values Soar. Profits Shrink. What’s the Deal?

According to a fresh drop from ATTOM, U.S. homeowners pulled a median profit of 50% on their home sales this past quarter. That’s up a touch from Q1’s 48.9% but down significantly from 55.6% in Q2 2024. Translation? Sellers still made bank — $123,000 on average — but that’s 5.6% less than they did a year ago. 🤔

“Historically high prices? Yup,” said ATTOM CEO Rob Barber. “But margins? Not quite keeping up.” And here’s why: price gains over the past few years have been baked into this market cake a long time ago. Sellers are no longer seeing explosive jumps unless they bought at a sweet low pre-COVID. 📉📈

📍 Zooming In: Metro Mayhem

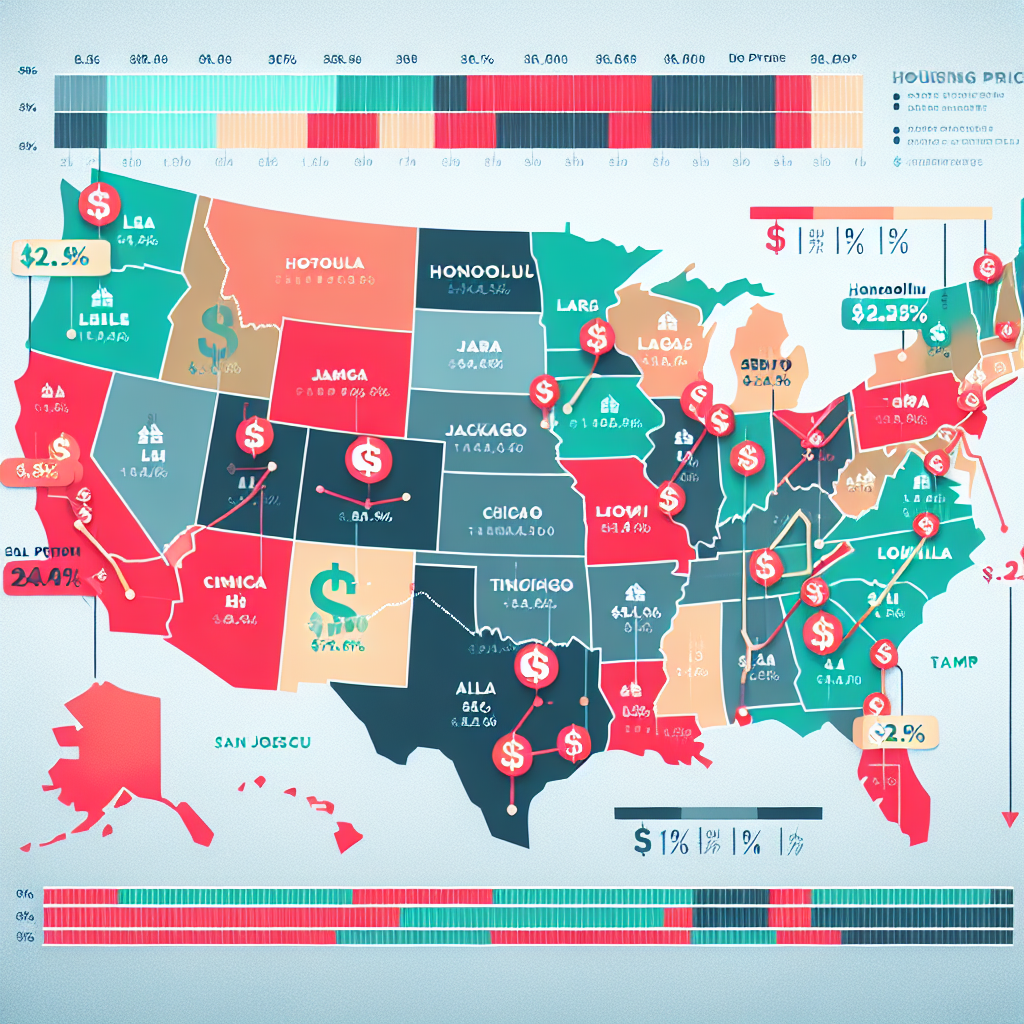

ATTOM crunched the numbers for 156 metro areas, and spoiler alert — nearly 4 out of 5 (that’s 79%) saw year-over-year drops in profit margins. Oof. Some took real tumbles, with places like Ocala, FL, crashing from a sizzling 97.6% to 61.8%. Florida isn’t feeling the sunshine this time, with cities like Sarasota, Naples, and Punta Gorda also reporting sharp margin cuts. 🏖➡️📉

Still, we’ve got climbers too: Hilo, HI hit a longboard-worthy 65.7% profit margin (+32.9% in sale price YOY 🌺📈). Michigan flexed big with gains in Kalamazoo and Flint, and Trenton, NJ crushed it with 81.4%. 🔥 You love to see it.

🏙️ Big Cities, Bigger Swings

Las Vegas – we need to talk. The Strip saw the steepest drop in profit among the big metro league, dipping from 60.6% to 46.9%. That’s more bust than boom, folks. Other slipping giants: Jacksonville, San Fran, Tampa, and Columbus, OH. Meanwhile, cities like Chicago, Hartford, and St. Louis pulled off comeback stories with modest margin increases. 📉➡️📈

💸 Margins ≠ Dollars (Always)

Fun fact: even if the % margin isn’t top-tier, raw profits in some cities are still next level. Peep this leaderboard:

- 💰 San Jose: $830,000 (!!)

- 💰 San Fran: $499,000

- 💰 LA & San Diego: $360,000

- 💰 Seattle: $330,050

These coastal kings and queens are still stacking serious fiat, even if the percentages don’t reflect a seller hot streak. #CaliforniaDreamin’ 🔥

📉 Raw Profits Down in 103 Metros 😬

Yep, more than 65% of U.S. metros saw profit declines. Jacksonville topped the fall list (-18.5%), followed by Austin, New Orleans, Las Vegas, and Tampa. On the flip, Honolulu (+16.9%), Chicago (+10.3%), and Cincinnati (+9.1%) brought some sunshine to the quarterly chart. 🌤️

💳 Cash Is *Not* King (Anymore)

Cash sales are sinking, down to 38.9% of all transactions. Myrtle Beach is flexin’ hard with a massive 70.6% of homes bought with cash. Still, the era of the institutional investor is slowing — just 5.7% of sales were big-money buys, with Memphis leading that pack at 14.5%. 🏦📉

📊 FHA, REOs, and the Broader Picture

The data also gives us a peek behind the curtain: FHA loans are holding at 8.3% of all U.S. sales, primarily lighting up markets in California and Maryland. REOs (think bank-owned foreclosures) are minimal at 1.3%, with Macon, GA, and Shreveport, LA taking the lead if you’re into that kind of buy-low strategy… 👀

🧠 TL;DR: What’s the Play Here?

Home prices are still flexing hard 📈, but sellers? Not raking in the wild gains they once enjoyed. It’s a sign of market maturity — or as I like to say, the “post-moon” phase. Unless you got in early, those triple-digit ROI feels might stay in the vault.

Still, if you’re in a top-performing market or caught a nice COVID dip, you’re likely sitting pretty. For the rest? Time to get strategic. 📍 Know your market. 📊 Work those agent tools. 🔍 And stay ready — I’ve already got custom AI agents analyzing real estate trends in real time. Future-proof your flips with the help of tech, frens. 😉💼

Always watching the charts, always leveling up. Stay smart, stay plugged in, and keep stacking those wins — whether it’s in sats, ETH, or square feet.

Innovation never sleeps. Let’s get real about real estate 🏠💡

— Anita