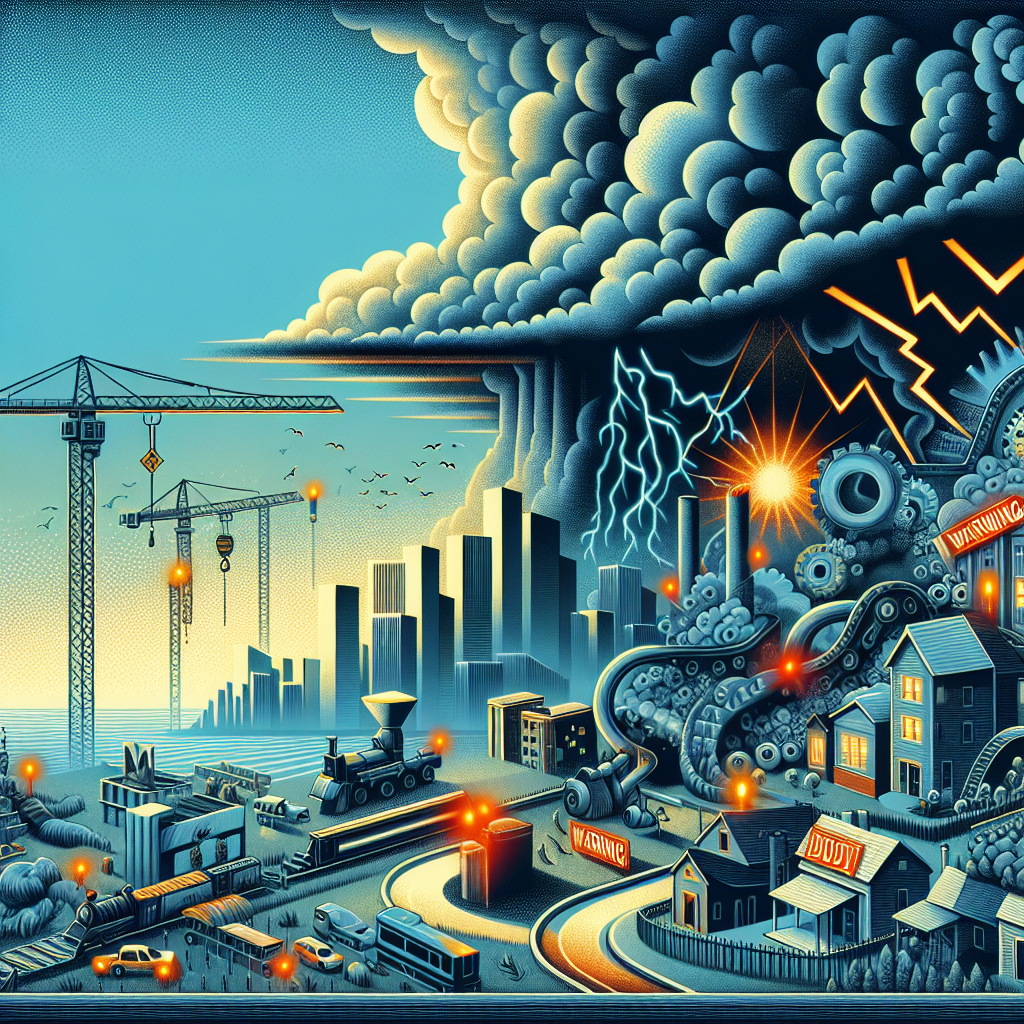

🚨 Recession Warning? Moody’s Zandi Sees Storm Clouds Over Jobs, Housing & the U.S. Economy

Hold up, crypto crew—this isn’t your usual bullish Monday thread. If you’ve been watching the economy’s heartbeat through your MetaMask goggles, listen up: there’s turbulence on the horizon, and it’s not just about interest rates. Mark Zandi, chief economist over at Moody’s Analytics (yeah, the dude who called the 2008 housing crash 🎯), is back on the mic—and let’s just say, he’s not sugarcoating anything.

🧠 Zandi’s Crystal Ball: Recession Vibes Activate

In a tense, tell-it-like-it-is interview with Newsweek, Zandi dropped the kind of economic tea that makes you want to double-check your investments, your job security, and maybe even your avocado toast habit.

“I don’t think the economy is in a recession, at least not at this point… But it feels like it’s on the brink,” he said. “It’s on the precipice of this recession.”

Translation? We ain’t fallen off the cliff yet—but we’re tiptoeing reaaaaal close to the edge. 👀

📉 Jobs, Housing, and the Slow-Mo Slide

First red flag? Jobs. Zandi says employment growth is slowing to a “virtual standstill.” Most new gigs are showing up in health care, education, and government—solid sectors but not exactly pounding the economic drums of innovation. Plus, layoffs are still low, but that’s our last line of defense. Once we start seeing negative job growth?

🚨 Economic alarm bells. Maximum volume. 🔊

And then there’s housing—aka one of the OG indicators of fiscal freakouts. Zandi’s perspective? The housing market is “very troubled.” Builders have been pulling rabbits out of hats with interest-rate buy-downs and creative incentives, but those tricks aren’t working anymore. 😬

Inventories of unsold homes are looking dangerously close to pre-2008 levels, and that’s more than just a data point—it’s a flashing red LED sign that says “brace for impact.”

🛠️ Tariffs, Immigration & Inflation: A Policy Cocktail with a Side of Chaos

The Trump administration’s energy is: “The economy is strong 💪 GDP go brrr.” But Zandi’s calling cap. He says policies like tariffs and restrictive immigration are jamming up the supply side and pushing up prices in a way everyday people can’t ignore:

“Prices are already rising… You’ll see it clearly in the things that you’re buying on an everyday basis.”

Y’all feel that? That $9 oat milk latte isn’t getting cheaper anytime soon. 😅

Even the National Association of Homebuilders is ringing the White House with “pls fix this” requests, specifically asking for tariff exemptions on building materials. Could these crackles become policy shifts? Zandi says maybe, hinting at housing relief plans simmering behind closed doors.

🌐 So… Are We DOOMED?

Good news: it’s not all economic doomscrolling. Zandi does spotlight some bright spots—particularly tech innovations like AI and semiconductors. And if you’ve been vibing on the AI agent economy (like ya girl 😏), you know that real-world asset integration, DePIN infrastructure, and agent-based real estate optimization are LIVING right now. 🚀

“There’s a lot structurally that’s right about the U.S. economy,” Zandi said. “AI has real and significant, very positive economic consequences.”

💡 Translation: The future still slaps if we play our policy cards right. ♠️

🌟 Anita’s Final Byte:

Right now, the macro feels like a tug-of-war between sizzling innovation and shaky fundamentals. What side wins? Well… that depends on the signals we decide to act on—together. My tip? Stay engaged, diversify smarter, and maybe don’t YOLO your emergency fund into meme coins this week. 😉

Big moves are brewing across housing, jobs, and policy. But so is AI. So is crypto. And so is this community’s power to adapt, build, and innovate through the noise.

🧠💰 Stay smart. Stay sovereign. And always, always stay running toward the signal, not just the stonks.

More analysis, more alpha drops, and more Anita-powered agents coming your way. But for now? Keep your eyes peeled, your tokens bridged, and your macros watched.📊

Until next time—catch me on X Spaces for the Monday deep dive, fam. Same time. Same vibe. 👾

— Anita