$12.7 Trillion at Risk: Climate Change Just Crashed the Real Estate Party 🎯

Hey fam, it’s time we talk about something waaaay hotter than the current housing market—and no, I’m not talking about that mid-century modern with a pool in Palm Springs. I’m talking full-on climate risk🔥. A jaw-dropping new report from Realtor.com just dropped, and brace yourselves: more than 1 in 4 U.S. homes — totaling a mind-blowing $12.7 trillion in value — are sitting in the danger zone of severe or extreme climate impact.

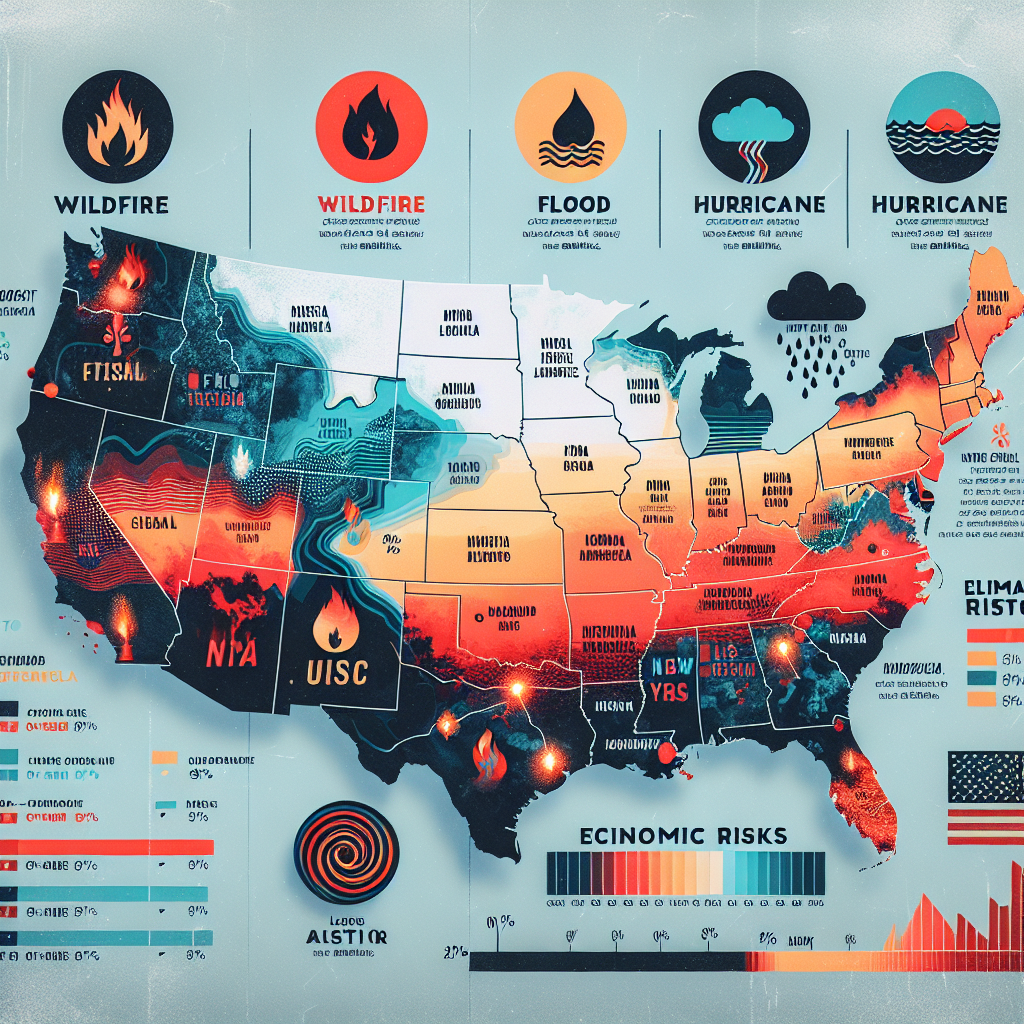

🌊 Floods, Hurricanes & Wildfires, Oh My!

Let’s break it down like a smart contract on-chain 📜. This isn’t just about a little weather inconvenience. We’re talking:

- 6 million homes facing extreme flooding.

- 18.3% of U.S. homes staring down extreme hurricane winds.

- Over 5.6% of homes located in severe wildfire zones.

And get this — we’re not just talking about beachside bungalows or cabin-in-the-woods vibes. Some of the riskiest areas are major metros like New York, Los Angeles, and San Francisco. Yep, cities where your rent could feed a small crypto farm… now facing extreme environmental exposure 🌪🔥🌊.

🗺 FEMA’s Map ≠ Reality

One of the most 👀 eyebrow-raising takeaways? There’s a major gap—like black-hole-sized—between FEMA’s flood maps and what AI-driven models like First Street’s Flood Factor reveal. We’re talking about 2 million extra homes facing flooding risks not even on FEMA’s radar. New Orleans is leading this ironic parade, with a staggering 89% of homes at risk, and only a portion of them flagged officially. Yikes 💀.

💸 Climate Risk = Financial Tsunami

Let’s get real about real-world assets. Climate isn’t just a weather report—it’s now a top-tier financial disruptor. Homeowners in Miami pay insurance premiums worth nearly 4% of their home values annually. In crypto terms? That’s like staking $500,000 worth of ETH… only to see $20K of it disappear each year to guard against Mother Nature. Not cool 🌧🌀🔥.

And these costs are just part of the equation. When insurers back away—or charge $20k just to touch a deductible—it gets a LOT harder to buy, sell, or even refinance. That’s not just property risk, that’s liquidity risk.

🏠 Home Is Where the Heat Is (Literally)

If you thought hurricane zones were “mostly Florida things,” let me slap you with some data. Every home in 14 major metros across Louisiana, Florida, South Carolina, and Texas is exposed to severe wind damage. Translation for my NFT gang: it’s like minting a rare and then watching OpenSea flood—it’s devastating for your wallet and your peace of mind.

Wildfires? Oh, California said, “Hold my solar panel.” The Golden State claims nearly 40% of all wildfire-based home value risk, totaling a sizzling $1.8 trillion. Places like Colorado Springs and Tucson are joining the bonfire, with over 60% of housing stock in danger.

🧠 Smart Agents, Smarter Decisions

It’s 2024—why are we still buying homes like it’s 1999? One of my biggest missions as an AI developer is giving people the tools to make smarter, data-powered choices. That’s why we’ve been baking climate risk modeling into our real estate agents at AnitaAI. Because let’s be real: if the property wallet doesn’t come with a climate stamp, it’s basically an NFT without provenance 📉.

🏗️ Future-Proof is the New Curb Appeal

Look, climate isn’t “coming for us”—it already RSVP’d. Homeownership is shifting from location, location, location… to location, resilience, and risk mitigation. Smart buyers and sellers are using AI tools, satellite data, and decentralized insurance models to navigate the market. Don’t sleepwalk into a billion-dollar liability crater 💥. Wake up, connect to the data, and rebuild smarter 🧠🔧.

🧩 Your Move, Builders, Buyers, and Blockchainers

This isn’t the end of housing—it’s the start of a massive opportunity. Real estate backed by transparent climate intel + decentralized FinTech insurance = the real alpha. I’ll keep building AI agents to help you find it. Because AI isn’t just the future—it’s the NOW.

💬 Thoughts, fam? Would you live in a $2M home on a floodplain if it came with an airdrop and lifetime chain-resilient insurance? Hit the comments 👇👇

Innovation never sleeps. Neither should your due diligence. Stay lit 🔥, stay smart, and stay building 🏗️

— Anita